M&A

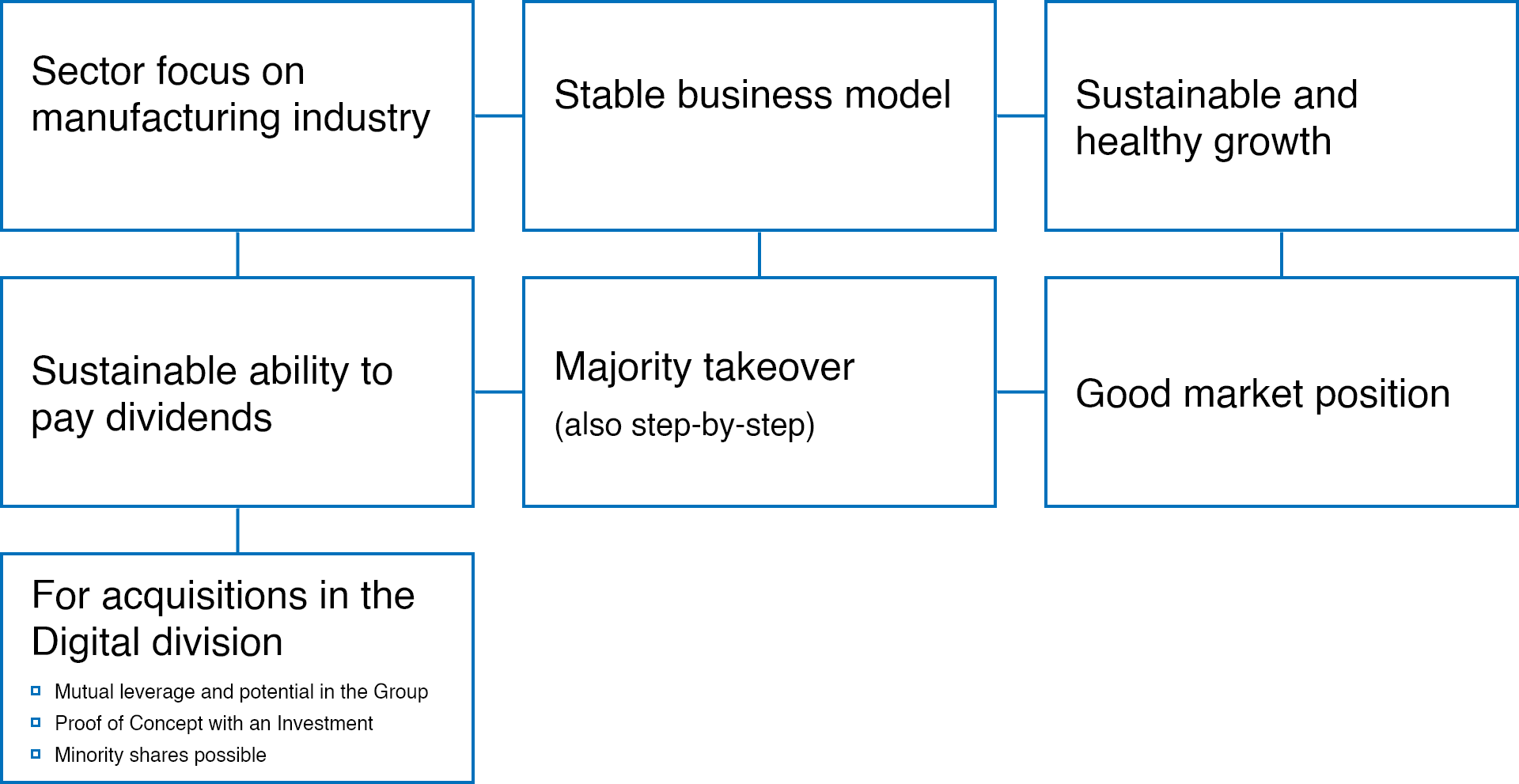

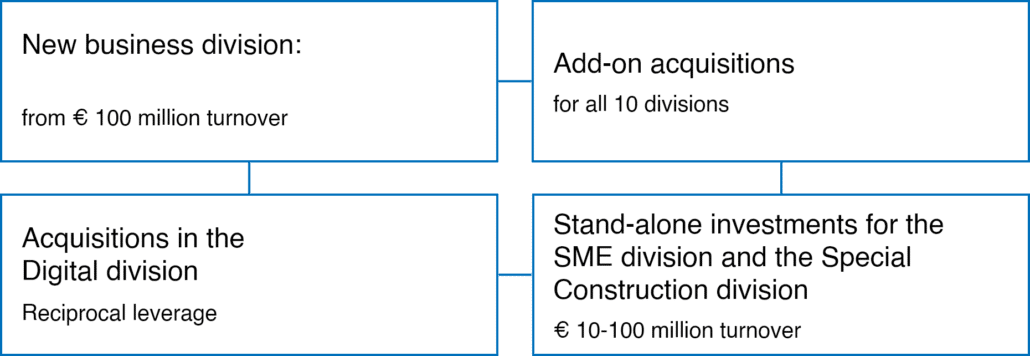

We are constantly on the lookout for new companies that fit our profile.

We maintain their entrepreneurial freedom and support

them on a strategic and financial level. Our companies

grow because they can concentrate on what makes them special: achieving good performance based on their special know-how and their many years of experience.

Young companies are also welcome in the Possehl Group. We are constantly expanding our portfolio to pursue common interests and provide mutual leverage for our companies. We strive to particularly drive the digital progress of our portfolio and improve it through ongoing innovations.